Individual investors must depend on the expertise of

managers of funds to manage a profitable portfolio. Investors need to trust

the management of the funds to deliver acceptable investment results and also

to provide the necessary diversification for smoothing the risks from the

variability of separate stocks. As a rule, only mutual funds with well over a

billion of invested assets should be purchased because there are economies of

scale from fees and the advantageous pricing of stocks when acquired in large

lots.

In this blog follows only mutual funds or ETFs or exchange-traded funds. The analysis avoids speculation by placing bets on individual stocks but that is riskier than a retired investor can tolerate.

Retired investors have only limited longevity for reaping investment

results for stocks that are subject to longer term cycles. Retirees also do not

have the knowledge required for trading individua (http://news.morningstar.com/fund-category-returns/)l stocks. This blog avoids purchasing separate stocks unless there are special circumstances where

the risks can be managed.

Multibillion accumulations of wealth from the stock market

trading have their origin from skillfully timing purchases of targeted shares.

Making informed purchases of special deals separates a few dozens of the well-known investors from what millions of retirees can hope to

realize. Retirees must depend on information that is available to the general

public, which means that the best they can do is to obtain returns that are

slightly better than the a benchmark index. Since the performance of an average

mutual fund is frequently less than a benchmark, with judicious choices an investor can choose on of

the few funds that have performed better than a benchmark. Satisfactory long-term profits come from a

careful selection of the right investment fund class before picking a fund that may

be showing short-term investment gains. There are 7,238 mutual funds, 1,411 ETF

funds and ten thousands of bond funds to select from.

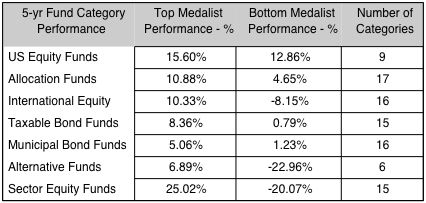

In this blog we have picked "Morningstar Medalist" funds showing superior investment performance one and extended time.

SOURCE: http://news.morningstar.com/fund-category-returns/

No comments:

Post a Comment

For comments please e-mail paul@strassmann.com