The stock market has been showing a wide disparity between its price and its underlying worth. Clearly, the S&P 500 is overvalued.

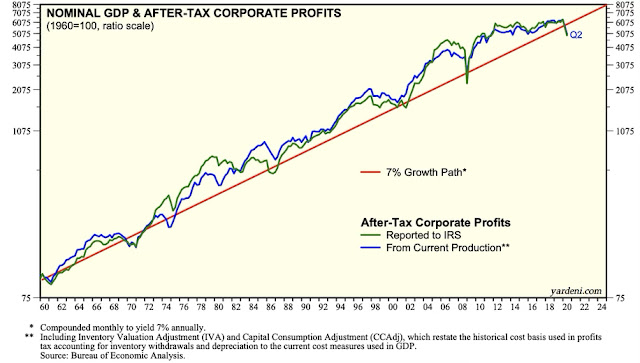

The rationale behind the rising stock market have been a steady increase in after tax profits. Actual profits have been rising steadily at 7%/annum whereas the S&P 500 has been rising last year near 80%/annum.

The rise of dividends has continued even though the rate of dividend increase as shown a moderate decline recently. Investors continue to buy stocks even though gains from dividends continue to maintain the worth of stock worth. That is how conservative investors continue to make investments that were not too risky.

The problem with conservative investments is the steady decline in the yield of keeping cash in low risk treasury bonds. Close to zero bond yields will drive investors to investments that yield no returns.

In recent years inflation has been modest in services (e.g. +2%) and negative in all other expenditures, Consequently, inflation has so far not been a threat to the holdings of conservatively invested retired persons.

Summary:

Retired investors should keep away from S&P 500 investments while keeping in cash money needed to support living expenses.

No comments:

Post a Comment

For comments please e-mail paul@strassmann.com