Fair Value = Future Earnings at Growth Stage + Terminal Value

= E(0) x(1-xn)/(1-x) + E(0)xn y/(1-y)

where x=(1+g)/(1+d), and y=(1+t)/(1+d)

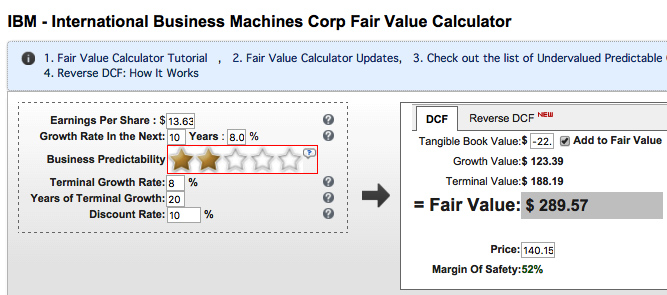

Parameters:

E(0) – current earnings per share; g – annual growth rate of revenues (usually 5 to 10% but based on the post ten years of revenue growth); d – discount rate (interest rate in excess of return on investment for the past ten years – usually 8 to 12%); t – growth rate at terminal state (a conservative estimate of revenue growth during the past ten years); n – number of years at the growth rate of g (estimate of the longevity of the firm, usually equal to the longest stream of revenues during the past ten years).

Example:

Warren Buffett's Holdings of 81 million IBM shares, or 8.43% of the company:

CONCLUSION:

Projecting holdings of IBM for ten years, the price of shares could be in the $400 to $500 range plus dividends, for a potential profit of >$1 billion.

No comments:

Post a Comment

For comments please e-mail paul@strassmann.com